News – Thought Leadership

Challenge funds – what, who, and why?

4 August 2022

- Teodora Chis

The last two decades have seen a rise in the use of challenge funds across a number of contexts, from international development and economic growth to place-based innovation and climate resilience.

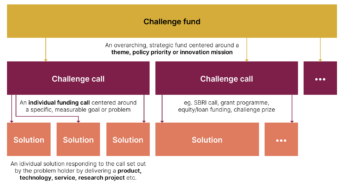

Challenge funds are overarching, strategic funds focused on fostering innovation around a specific mission, theme or policy priority

With the growing popularity of challenge funds comes a risk of losing sight of what makes this approach unique.

In fact, our review of academic and grey literature around challenge funds has shown us that they tend to be defined in considerably different ways across different contexts. For those looking to implement challenge funds, this could mean missing out on some of the most significant advantages of this approach to innovation funding.

To tackle this, we reviewed the existing literature on the topic, spoke to experts and practitioners, and tapped into our internal know-how on running challenge funds (including the Ofwat Innovation Fund, the Mayor’s Resilience Fund, and the Climate Smart Cities Challenge). This research effort allowed us to gain a deep and diverse understanding of the topic.

How we define challenge funds

In a challenge fund, the funding is disbursed through a series of individual challenge calls aligned to the overall objective of the fund.

Challenge calls can take multiple approaches to awarding money. For instance, one call may use challenge prizes (such as the London Mayor’s Resilience Fund), while another may provide funding through a combination of grants, working capital, and loans (such as the African Enterprise Challenge Fund).

This means that challenge calls can support innovative solutions at different stages of development – effectively allowing organisations to use the challenge fund format to create a portfolio of innovation funding interventions.

The key features of challenge funds

Challenge funds are portfolios of strategic investments deployed in a flexible yet targeted manner

At their best, challenge funds balance flexibility and strategic direction. By distributing money through a series of challenge calls, funders have the option to tailor the timing and choice of funding instruments to the unique features of the problem they are tackling. At the same time, they can use the challenge fund umbrella to ensure that the calls maintain a unified strategic direction.

This means that, rather than deploying a variety of funding instruments in a piecemeal approach, challenge funds concentrate activity around a defined set of goals, and generate a portfolio of investments building toward the same mission.

This has been the case with the Ofwat Innovation Fund, which features a cohesive yet flexible strategy for innovating the water sector, addressing challenges such as the climate crisis, more volatile weather, and population growth.

Challenge funds offer an open, non-prescriptive approach to innovation

Similar to other mission-oriented innovation approaches, challenge funds are well suited for complex problems that lack solutions. They set out problems to be solved and opportunities to be grasped, but don’t specify the route to the desired outcomes – unlike, for instance, procurement exercises, where the solution is readily defined.

This means that funders can look for solutions in many different places, and source ideas from a broad range of innovators rather than focus on the incumbents who are already well-funded. Moreover, they can encourage collaboration across disciplines, and help entire systems change.

At Challenge Works, we have run a number of open innovation challenges that have sparked new partnerships – such as those between community lenders and fintechs that started as part of the Affordable Credit Challenge – and unexpected solutions – such as Kraken Flex’s response to our Dynamic Demand Challenge.

Challenge funds centre innovation around problems that need to be solved and challenges and missions that need to be tackled

Another way challenge funds align with the broader ethos of mission-oriented innovation is that they are designed around addressing problems, challenges and missions, as opposed to funding specific inputs or processes (such as providing a certain amount of funding to a specific economic sector over a certain period of time).

This has a number of advantages – such as enabling the public sector to play a more active role in shaping the direction of innovation and economic development, or breaking down silos between different levels of government, economic sectors and stakeholder groups.

For instance, the Climate Smart Cities Challenge enabled the participating cities to articulate the specific challenges they faced in accomplishing the overall aspiration of the challenge fund – advancing solutions toward net zero – and provided the right context for cities to reach innovators at a global scale. The problems in question were highly specific to the context of each city, and included issues such as the need to create scalable ways to develop zero-carbon, energy-efficient, affordable homes, in the case of Makindye Ssabagabo, or to improve freight mobility and reduce congestion-based greenhouse gas emissions, in the case of Bogotá.

Challenge funds feature clearly defined criteria for what their expected outcomes and impact are.

Challenge funds make use of transparent, clearly defined criteria for what success looks like in order to select the solutions that deliver the best outcomes. Not only does this help funders select the best-performing solutions – it also ensures fairness, and creates opportunities to build learning and evidence along the way.

For instance, the Afri-Plastics Challenge features a series of rigorous criteria for each of its three strands, which have helped judges select the best solutions to move forward to the finalist stage given their environmental, social, and gender impact – while also incentivising innovators to build evidence around their work.

Conclusion

Challenge funds are an effective way to incentivise innovation. If done right, they can solve problems, bring different stakeholders together, and help funders support the best solutions with rigour, strategic soundness, and flexibility.

However, the process of designing and delivering a challenge fund goes beyond identifying a theme and launching a series of calls for solutions. In our next blog post in this series, we will tackle some of the details that go behind the scenes of a challenge fund.

Categories

-

![transp-brain-Web-Large-16x9]()

Launching the £7.5 million Longitude Prize on ALS

-

![2025-05-29- Challenge Works Manchester Prize-44]()

10 AI-powered solutions announced for the Manchester Prize: Clean Energy Systems

-

![SDCP - Couple]()

Introducing the 10 Smart Data Challenge Prize finalist teams

-

![GSC-HERO-SEAsia-2-1920x1080]()

Introducing the Good Start Challenge

-

![27.03.2025 Challenge Works _ London Filmed 192 (1)]()

A Starry Night of Innovation: The Aqualunar Challenge Winners’ Event

-

![coloured pencils]()

How can we champion diversity and inclusion in a changing geopolitical landscape?

Blog